Vendor Registration Expert provides comprehensive services for the filing of the Beneficial Ownership Information Report (BOIR), a critical compliance requirement mandated by the Corporate Transparency Act (CTA). Our goal is to ensure your business meets these new federal requirements efficiently and accurately.

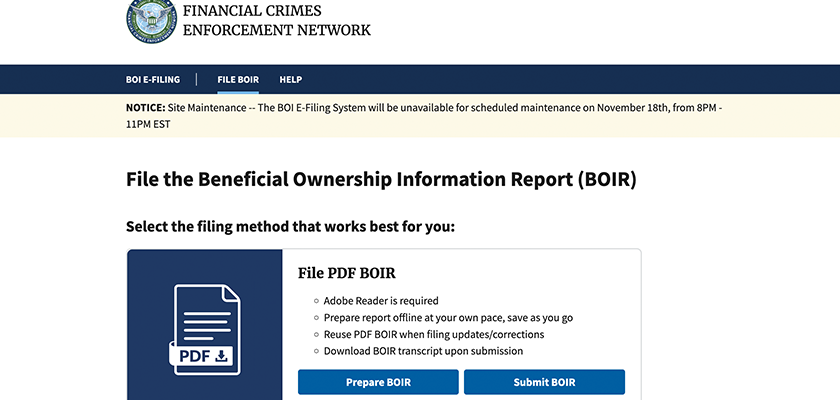

What is BOIR?The BOIR is a federal filing requirement that mandates U.S. businesses to report detailed information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This initiative aims to enhance transparency in business ownership, assist law enforcement in tracking illegal activities, and combat financial crimes such as money laundering and fraud.

Who Needs to File a BOIR?

Required Documentation for BOIR Filing

Filing a BOIR requires collecting and reporting specific details about the beneficial owners of the company, which include:

Identifying Information: Names, addresses, and dates of birth of all beneficial owners. Tax Identification Numbers: Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) for each owner.

Ownership Details: Information detailing the ownership structure, including percentages of ownership and voting rights.

1. Compliance Assurance: Ensures your business complies with the Corporate Transparency Act, avoiding penalties and legal issues.

2. Simplified Process: We take the complexity out of compliance by managing the entire BOIR process, from documentation to submission.

3. Expert Guidance: Our team stays updated on all regulatory changes, providing you with expert advice and ensuring continuous compliance.

Consequences of Non-Compliance with BOIR Filing

Failing to file the Beneficial Ownership Information Report (BOIR) or inaccurately reporting the required information can lead to significant legal and financial repercussions. Understanding the consequences of non-compliance is crucial for any business obligated under the Corporate Transparency Act (CTA).

Legal and Financial Penalties

Fines: Businesses that fail to file a BOIR, or file an incomplete or inaccurate report, can face substantial fines. The penalties can reach up to $500 per day for each day the violation continues, accumulating to a substantial amount if not addressed promptly. Criminal Charges: In cases where non-compliance is found to be willful, individuals involved may face criminal charges, which could include imprisonment. This is particularly true if the failure to report is linked to attempts to conceal illegal activities such as money laundering or fraud.

Impact on Business Operations

Audit and Investigations: Businesses that do not comply with BOIR requirements may be subjected to audits and investigations, which can disrupt business operations and consume significant resources.

Reputational Damage: Non-compliance can lead to a loss of business credibility and trust among partners, investors, and customers. The reputational damage can be long-lasting and more costly than the fines themselves.

Barriers to Future Opportunities: Non-compliance can affect a business’s ability to secure future funding or partnerships, as it may be viewed as a risk by potential investors or financial institutions. It could also influence future licensing and permit decisions by regulatory bodies.

Compliance Obligations

It's essential for businesses to understand their obligations under the Corporate Transparency Act and ensure all beneficial ownership information is accurately reported in a timely manner. Staying compliant involves:

Regular Updates: Promptly updating the BOIR with any changes in beneficial ownership within the specified time frame.

Accuracy of Information: Ensuring that all information provided in the BOIR is accurate and fully reflective of the current ownership and control structure.

Understanding the Requirements: Keeping informed of any changes in the reporting requirements or processes related to the BOIR.